Want to speak with someone?

Still unsure and want to speak with someone? Set up a time here.

Schedule a callResearch

Three Things (12/18)

Three Things (12/18)

Dec 18, 2024

Masa Son doubles down

Bold backing … SoftBank CEO Masayoshi Son has pledged $100 billion to U.S. projects, focusing on AI, energy, and tech infrastructure. Announced alongside President-elect Donald Trump at Mar-a-Lago, the commitment mirrors Son’s 2016 promise of $50 billion, which drew attention for its scale and ambition.

SoftBank, one of the world’s most influential tech investors, is known for bold, high-risk bets. Son’s Vision Fund, launched in 2017 with $100 billion, backed companies like Uber (UBER) and Arm Holdings (ARM). While high-profile flops like WeWork (delisted from the NYSE in 2023) left scars, recent wins like Arm’s standout IPO have restored some optimism.

Son made no similar pledges during the Biden presidency, focusing instead on managing SoftBank’s Vision Fund struggles at the time. This latest move highlights Son’s tendency to align major investments with political transitions in the U.S.

The $100 billion will target infrastructure to support AI, including data centers, energy solutions, and chip manufacturing. SoftBank’s cash alone can’t cover the amount, so Son will likely seek outside investors or raise new debt, per WSJ reporting.

Son, a UC Berkeley graduate with deep ties to the U.S., calls himself an “architect of the future,” betting heavily on AI. While experts applaud his ambition, they question whether such pledges translate into real job creation.

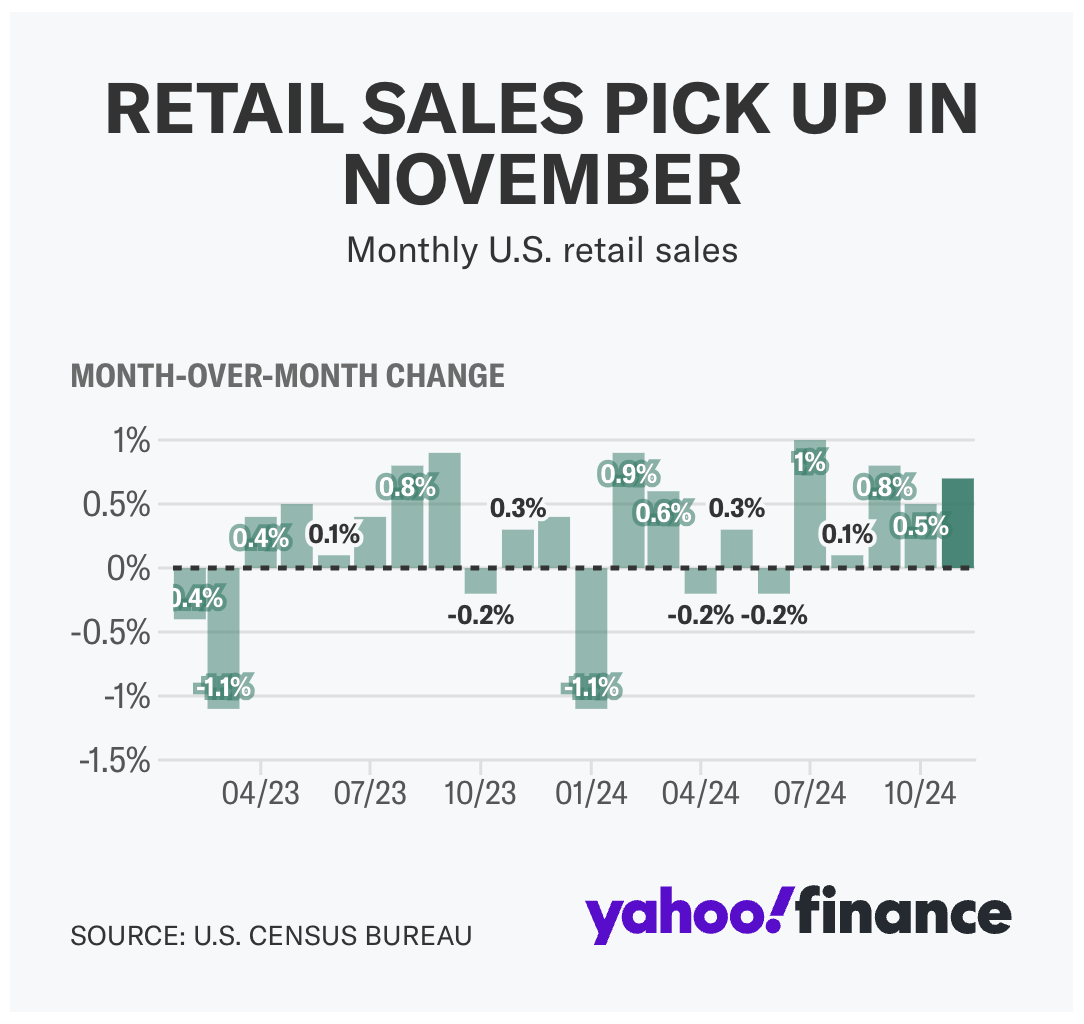

Retail sales top forecasts

Consumer comeback … US retail sales grew 0.7% in November, beating Wall Street’s forecast of 0.6%. The results signal a resilient consumer and a promising start to the critical holiday shopping season.

One standout category was auto sales. Purchases of vehicles and parts surged 2.4% month-over-month, the strongest showing in over three years as interest rates dipped and dealerships offered deep year-end discounts. Online shopping also jumped, climbing 1.8%, driven by Black Friday and Cyber Monday promotions on platforms like Amazon and TikTok Shop.

While overall sales beat expectations, growth elsewhere showed mixed results. Excluding autos and gas, sales rose just 0.2%, missing analyst estimates of 0.4%. The “control group”—which strips out volatile sectors and feeds GDP data—met expectations with a 0.4% gain.

Economists agree the results highlight consumer resilience but flag potential headwinds for 2025. Speaking to Yahoo Finance, Wells Fargo’s Tim Quinlan noted concerns over rising tariffs and slowing income growth, which could weaken spending next year.

Despite challenges, early holiday spending is strong. Retailers saw robust traffic across digital and physical stores, with consumer confidence buoyed by a favorable economic outlook.

The results also add context for the Federal Reserve, which is widely expected to cut interest rates soon. Investors will watch closely as Fed Chair Jerome Powell shares updated economic projections following the FOMC meeting later today.

Forecasting the future

Trend tracking … 2025 predictions are here. Increasingly driven by data rather than editorial opinion, these forecasts could offer clues for investors as they evaluate opportunities in the year ahead. From shifting styles to new retail approaches, the trends signal changing consumer preferences over time.

Trends continue to head West. According to FastCo Design, the American West’s influence—think bolo ties and cowboy boots—will go even more mainstream in 2025. In the entertainment world, the series finale of “Yellowstone” recently notched 11.4 million viewers, a new record for Paramount (PARA). In 2024, there was a 20% global increase in monthly streams for country genre compared to last year, per Spotify (SPOT) data.

Another standout? Purple. Shades from soft lavenders to deep violets are expected to dominate, blending seamlessly with Pantone’s Color of the Year for 2025: Mocha Mousse. The versatile brown offers warmth and sophistication, and was announced alongside collaborations with Motorola (MSI), Wix (WIX), and Post-it Notes (MMM).

Discovery engine Pinterest (PINS) made some predictions of its own based on data from its more than 500 million unique monthly visitors. In the realm of fashion, Pinterest predicts consumers will embrace maximalism and bold expression, including the “Salvador Dali aesthetic.” For the home, consumers are increasingly pinning content related to sustainable living and recycled fashion. Additionally, carbonated beverages will still be dominant, albeit with a twist. Pinterest found that users are increasingly seeking out old-school soda pop recipes.

One more thing: Pfizer (PFE) provided 2025 sales and earnings guidance that aligns with Wall Street expectations, reassuring investors and pushing shares up after recent declines. That said, some experts believe the looming confirmation of RFK Jr. as health secretary could bring uncertainty, as his history of vaccine skepticism may impact Pfizer’s relationship with regulators and its public image.

Disclosures:

© Copyright 2023 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan. Cryptocurrency trading is provided by Bakkt Crypto Solutions LLC ("Bakkt Crypto"). Bakkt Crypto is not a registered broker-dealer or a member of SIPC or FINRA. Cryptocurrencies are not securities and are not FDIC or SIPC insured. Bakkt Crypto is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. Cryptocurrency execution services are provided by Bakkt Crypto (NMLS ID 1828849) through a software licensing agreement between Bakkt Crypto and Titan. Please ensure that you fully understand the risks involved before trading: bakkt.com/disclosures.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.